-

Brass Connector Pin For IEC EV Charging Plug

Brass Connector Pin For IEC EV Charging Plug

-

Contact Pins For Sae EV Charging Plug

Contact Pins For Sae EV Charging Plug

-

Charging Pin Connector For GB/T EV Charging Plug

Charging Pin Connector For GB/T EV Charging Plug

-

NACS Connector Pin For Tesla EV Charging Plug

NACS Connector Pin For Tesla EV Charging Plug

-

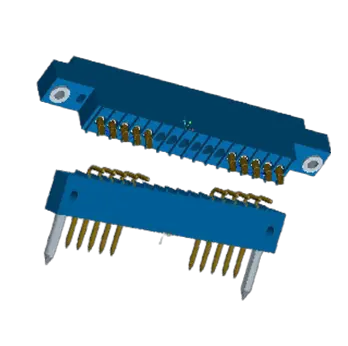

Lamella Contact Pins

Lamella Contact Pins

-

Hyperboloid Contacts

Hyperboloid Contacts

-

Crown Spring Pins

Crown Spring Pins

-

Energy Storage Socket Connector

Energy Storage Socket Connector

-

Energy Storage Plug Connector

Energy Storage Plug Connector

-

SS1 Series Connector for Energy Storage Connector

SS1 Series Connector for Energy Storage Connector

-

SS2 Series Connector for Energy Storage Connector

SS2 Series Connector for Energy Storage Connector

-

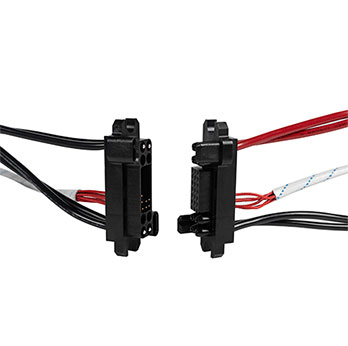

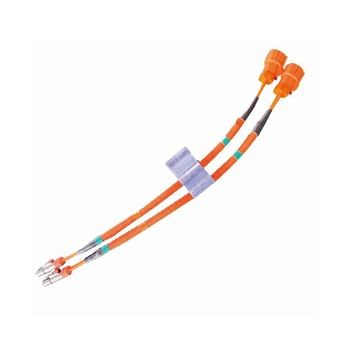

Custom Cable Harness Assembling

Custom Cable Harness Assembling

-

Wiring Harness Connector

Wiring Harness Connector

-

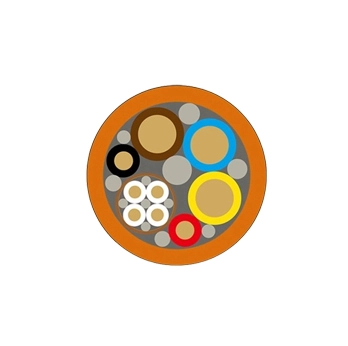

EN50620 Cables

EN50620 Cables

-

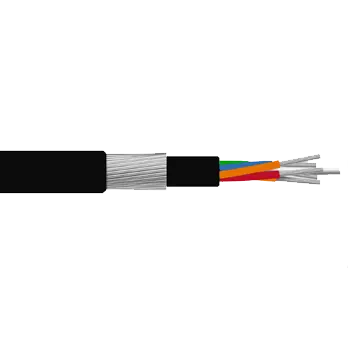

Electric Vehicle Charging Cable

Electric Vehicle Charging Cable

-

Elevator & Conveyor Cable

Elevator & Conveyor Cable

-

Industrial Cables And Wires

Industrial Cables And Wires

-

AC Charging Connector

AC Charging Connector

-

DC Charging Connector

DC Charging Connector

-

Type 2 Open End Charging Cable

Type 2 Open End Charging Cable

-

Type 2 -Type 2 Charging cable

Type 2 -Type 2 Charging cable

-

CHAdeMo Connector

CHAdeMo Connector

-

GB/T DC Charging Connector

GB/T DC Charging Connector

-

NACS Vehicle Plug

NACS Vehicle Plug

-

Mode 2 GBT Portable EV Charger

Mode 2 GBT Portable EV Charger

-

J1772 SAE Type 1 Portable EV Charger

J1772 SAE Type 1 Portable EV Charger

-

IEC62196 Type 2 Portable EV Charger

IEC62196 Type 2 Portable EV Charger

-

DC EV Charger

DC EV Charger

-

AC Socket Cable(AC Socket→Battery)

AC Socket Cable(AC Socket→Battery)

-

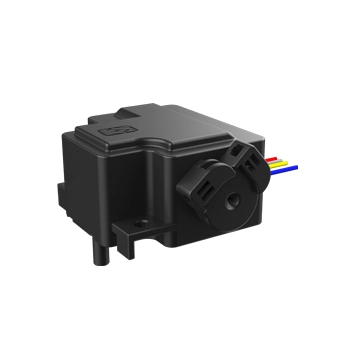

PDU Cable(Battery→Motor)

PDU Cable(Battery→Motor)

-

Motor Wire

Motor Wire

-

PTC Cable(Battery→Air Conditioner)

PTC Cable(Battery→Air Conditioner)

-

DC Socket Cable(DC Socket→Battery)

DC Socket Cable(DC Socket→Battery)

-

Ground Wire

Ground Wire

-

Three Phase Power Line

Three Phase Power Line

-

Air Pump Line→Compressor

Air Pump Line→Compressor

WHAT ARE YOU LOOKING FOR?